Understanding Revocable Trusts: A Comprehensive Guide

When it comes to estate planning, revocable trusts are like the Swiss Army knives of the financial world. They’re versatile, adaptable, and—let’s be real—super handy. If you’re wondering how to create a revocable trust or curious about the benefits of a revocable trust, you’ve landed in the right place.

In this guide, we'll break down everything you need to know about revocable trusts, their benefits, how they stack up against irrevocable trusts, and the costs involved in setting one up. Ready? Let’s dive in!

What is a Revocable Trust?

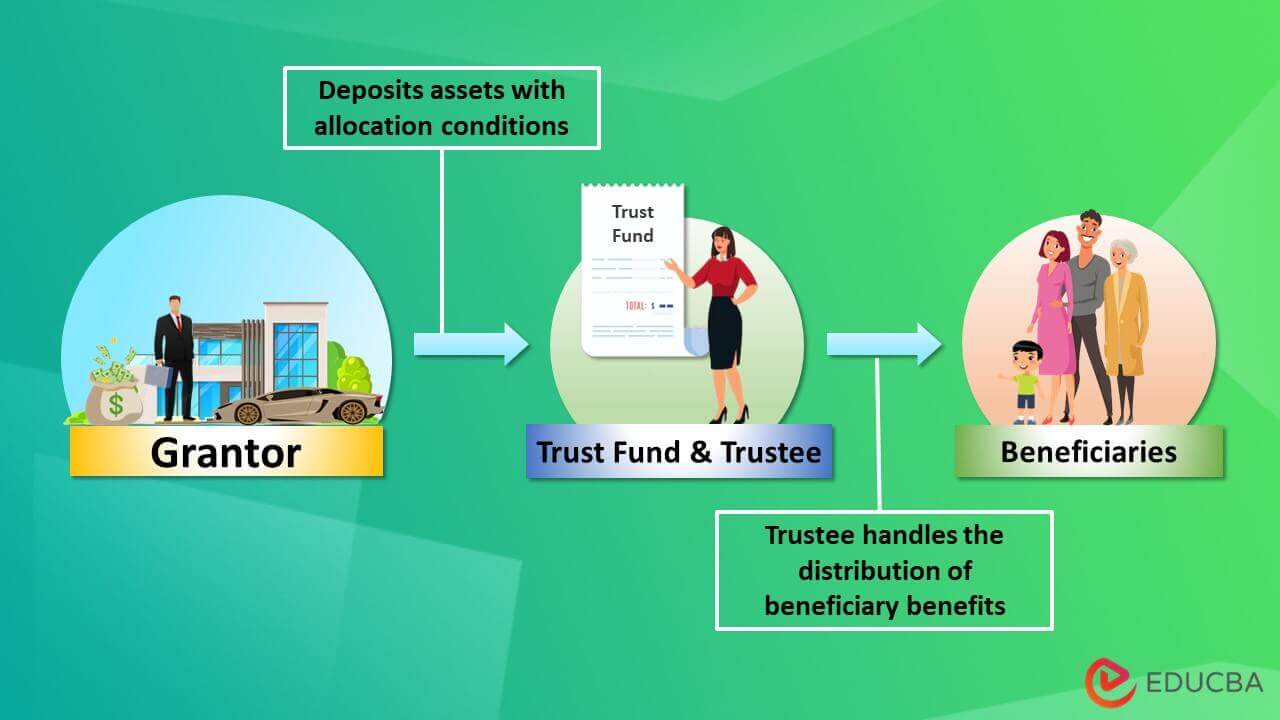

A revocable trust, also known as a living trust, is a legal entity that holds your assets during your lifetime, allowing you to manage them while you’re alive and distribute them after your death. The best part? You can change or revoke it at any time.

Key Features of Revocable Trusts

- Flexibility: You can amend or dissolve the trust whenever you want.

- Control: You maintain control of your assets while you’re alive.

- Avoiding Probate: Assets in a revocable trust typically bypass probate, making the transition smoother for your heirs.

Why Should You Consider a Revocable Trust?

Let’s be honest: who wants their loved ones tangled up in court after they’re gone? Here are some compelling benefits of a revocable trust:

1. Avoiding Probate

- Speedy Distribution: Your assets can be distributed quickly to your beneficiaries without the lengthy probate process.

- Privacy: Unlike wills, which become public records, revocable trusts keep your estate matters private.

2. Flexibility

- You can change the terms of the trust whenever you want. This adaptability is crucial as life circumstances change.

3. Incapacity Planning

- If you become incapacitated, a successor trustee can take over management of the trust, ensuring that your affairs are handled without court intervention.

4. Tax Benefits

- While revocable trusts don’t offer tax advantages during your lifetime, they can provide benefits in estate tax planning.

Revocable Trust vs. Irrevocable Trust: What’s the Difference?

Now, let’s get down to the nitty-gritty: revocable trust vs irrevocable trust. Here’s a quick comparison to help you decide which one might suit your needs better:

| Feature | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Control | You can modify or revoke it anytime | Once established, it can't be changed |

| Asset Protection | No asset protection | Assets are protected from creditors |

| Tax Implications | Income taxed to you | May reduce estate taxes |

| Probate Avoidance | Yes | Yes |

As you can see, if you’re looking for flexibility and control, revocable trusts are the way to go. But if asset protection is your primary concern, an irrevocable trust may be more suitable.

How to Create a Revocable Trust

So, how do you actually create a revocable trust? Here’s a simplified step-by-step guide:

Step 1: Define Your Goals

- Determine what you want to achieve with the trust. Is it primarily for avoiding probate, or do you have specific heirs in mind?

Step 2: Choose a Trustee

- You can be your own trustee initially, but consider appointing a successor trustee who can manage the trust after your passing.

Step 3: Create the Trust Document

- Draft a trust agreement outlining the terms, conditions, and beneficiaries. This is where you may want to consult an attorney to ensure it's legally sound.

Step 4: Fund the Trust

- Transfer your assets into the trust. This can include bank accounts, real estate, and investments. Remember, an unfunded trust is like a car without gas—it won’t go anywhere!

Step 5: Review Regularly

- Life changes, and so should your trust. Review and update it regularly to reflect changes in your assets or family situation.

The Cost of Setting Up a Revocable Trust

Now, let’s talk dollars and cents. The cost of setting up a revocable trust can vary widely depending on several factors:

- DIY vs. Professional Help: You can find templates online for a DIY approach, which may cost you just a few hundred dollars. However, hiring an attorney will typically range from $1,000 to $3,000, depending on the complexity of your estate.

- State Fees: Some states may have filing fees or other costs associated with establishing a trust.

- Ongoing Maintenance: Remember to factor in any potential costs for updating or managing the trust over time.

Key Takeaways

In summary, a revocable trust can be a powerful tool for managing your estate. Here’s a quick recap of what we've covered:

- Revocable trusts offer flexibility and control, allowing you to manage your assets while avoiding probate.

- Understanding the differences between revocable and irrevocable trusts is crucial for effective estate planning.

- Creating a revocable trust involves defining your goals, choosing a trustee, drafting the trust document, funding it, and regularly reviewing it.

- The cost of setting up a revocable trust can vary, so weigh your options carefully.

Final Thoughts

Whether you’re just starting your estate planning journey or looking to enhance your current setup, a revocable trust can help you achieve peace of mind. It’s all about making sure your wishes are honored and your loved ones are taken care of. So, why not take the plunge? Your future self (and your heirs) will thank you!

Ready to talk to an expert? Get in touch with an estate planning attorney today to get started on creating your revocable trust!