Are You Eligible? Understanding Spousal Survivor Benefits

When it comes to planning for the future, understanding spousal survivor benefits is crucial. These benefits can provide crucial financial support to a surviving spouse after the death of their partner. But hold on, are you eligible? Let’s dive into the nitty-gritty of spousal survivor benefits eligibility, how to apply, and what you need to know to secure that financial safety net.

What Are Spousal Survivor Benefits?

Spousal survivor benefits are a type of Social Security benefit designed to provide financial assistance to the surviving spouse of a deceased worker. They can be a game-changer in ensuring financial stability after a partner's passing.

Who Is Eligible for Spousal Survivor Benefits?

Eligibility for spousal survivor benefits can hinge on several factors. Let’s break it down into digestible pieces:

Requirements for Spousal Survivor Benefits Eligibility

- Marriage Duration: You must have been married to the deceased spouse for at least nine months before their death, unless it was due to an accident.

- Age Requirement: Generally, you must be at least 60 years old to apply for spousal survivor benefits. If you're disabled, you can apply as early as 50.

- Divorce Considerations: If you were divorced, you may still qualify for survivor benefits under certain conditions. (More on that later!)

- Social Security Contributions: The deceased must have worked long enough and paid into Social Security.

Spousal Survivor Benefits Eligibility for Divorced Spouses

Yes, you read that right! If you were married for at least ten years and are now divorced, you can still be eligible for spousal survivor benefits. Here’s what you need to know:

- Ten-Year Rule: Your marriage must have lasted a minimum of ten years.

- Single Status: You must be unmarried at the time you apply for the benefits.

- Age and Disability: The same age and disability considerations apply as for married spouses.

How to Apply for Spousal Survivor Benefits Eligibility

Ready to take the plunge? Here’s a step-by-step guide on how to apply for spousal survivor benefits eligibility:

-

Gather Documentation: You’ll need:

- A marriage certificate (or divorce decree, if applicable)

- The deceased’s Social Security number

- Your birth certificate

- Proof of your age (like a driver’s license or passport)

-

Visit the Social Security Administration (SSA) Website: Head over to the SSA website to find detailed information and access applications.

-

Choose Your Application Method:

- Online Application: Fast and convenient; ideal for tech-savvy folks.

- In-Person Appointment: If you prefer a personal touch or have questions, make an appointment at your local SSA office.

- Phone Application: Call the SSA at 1-800-772-1213 to apply over the phone.

-

Submit Your Application: Follow the instructions, provide all necessary documentation, and submit your application.

-

Follow Up: After applying, keep an eye on your application status through the SSA website or by calling.

Spousal Survivor Benefits Eligibility Age Requirements

Understanding the age requirements is crucial for your planning. Here’s a quick snapshot:

- 60 Years Old: You can start receiving reduced benefits.

- Full Retirement Age: If you wait until your full retirement age (which varies based on your birth year), you can receive the full benefit amount.

- Disability: If you’re disabled and between 50 and 60, you can still qualify.

Key Factors That Affect Your Benefits

Several factors can influence the amount you’ll receive. Here’s what to keep in mind:

- Your Own Work Record: If you’ve worked and contributed to Social Security, you may receive benefits based on your earnings.

- Deceased Spouse’s Work Record: The benefits you receive are generally based on the deceased spouse’s earnings record.

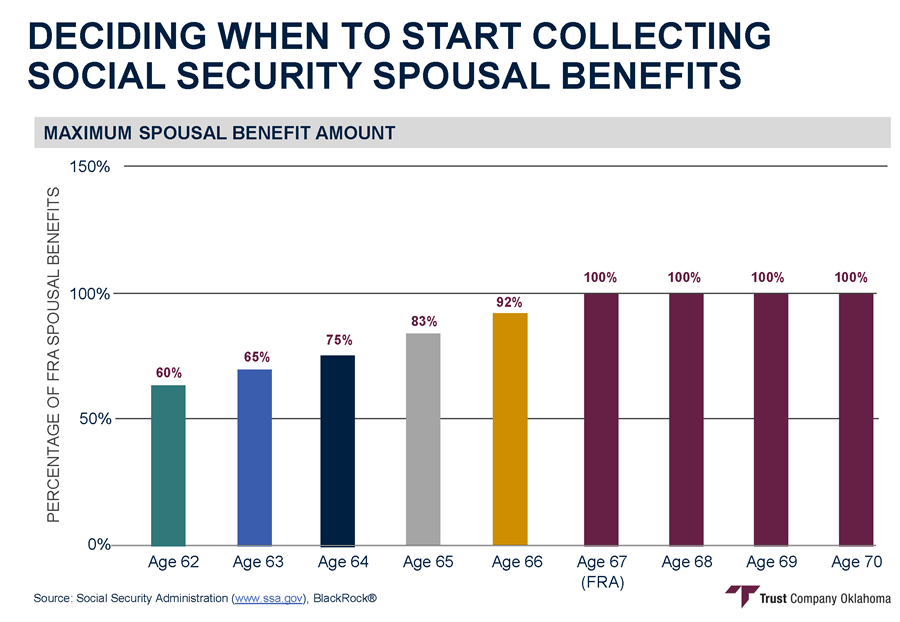

- Timing of Your Application: When you apply can affect your benefit amounts. Delaying your application until your full retirement age can maximize your benefits.

Common Questions About Spousal Survivor Benefits

1. Can I get benefits if my spouse was not receiving Social Security?

Yes, if your spouse worked long enough and earned enough credits, you can still qualify for survivor benefits.

2. What if I remarry?

If you remarry before age 60, you generally lose your eligibility for survivor benefits. However, if you remarry after 60, you can still receive them.

3. How long does the application process take?

Typically, it can take a few weeks to a few months, so it’s best to apply as soon as you’re eligible.

Conclusion

Understanding spousal survivor benefits eligibility is essential for anyone planning their financial future. Whether you’re married, divorced, or thinking about your retirement options, knowing the rules can help you secure the benefits you deserve.

So, are you ready to take the next step? Gather your documents, choose your application method, and dive into those spousal survivor benefits. Your future self will thank you!

Key Takeaways

- Eligibility hinges on marriage duration and age.

- Divorced spouses have options too.

- Apply online or in-person for convenience.

- Timing can maximize your benefits.

If you have more questions, don’t hesitate to reach out to the Social Security Administration or consult with a financial advisor to navigate your options!