Essential Diversification Strategies For Your Retirement Investments

Retirement might seem like a distant dream for some, but let’s be real: the earlier you start thinking about it, the better. If you want your golden years to be more “relaxing on a beach” than “counting pennies,” you need to talk diversification. In this article, we’ll cover strategies for diversification in retirement investments, the benefits of diversifying your retirement investment portfolio, and how you can achieve stability in your investments. Ready to dive in? Let’s go!

Why Diversification Matters

You might be asking, “Why should I bother diversifying my retirement investments?” Picture this: you’ve saved up a nice nest egg, but it’s all in one type of investment. Suddenly, the market takes a nosedive. Ouch! Diversification helps you reduce risk by spreading your investments across various asset classes, which can cushion the blow when things go south.

The Benefits of Diversifying Your Retirement Investment Portfolio

- Reduced Risk: By diversifying, you’re not putting all your eggs in one basket. If one investment tanks, others might still flourish.

- Potential for Higher Returns: Different assets perform well at different times. When one sector is down, another may be up, providing a better overall return.

- Inflation Protection: Diversifying into assets like real estate or commodities can help shield your portfolio from inflation.

- Greater Flexibility: A diversified portfolio can adapt to changing market conditions, helping you stay on track towards your retirement goals.

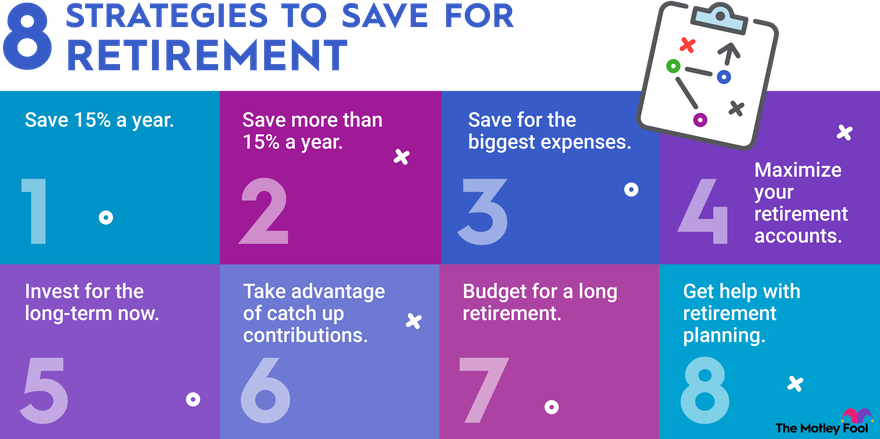

How to Diversify Retirement Investments for Stability

So, how do you actually go about diversifying? Let’s break it down into digestible steps.

1. Assess Your Risk Tolerance

Before you throw your money around, figure out how much risk you’re willing to take. Are you a daredevil who loves high-risk stocks, or do you prefer the safety of bonds? Knowing this will help tailor your investment strategy.

2. Mix Asset Classes

Don’t just stick to stocks. Here’s a quick breakdown of some best assets for retirement investment diversification:

- Stocks: Great for growth but can be volatile.

- Bonds: Generally safer and provide steady income.

- Real Estate: Offers potential for appreciation and rental income.

- Mutual Funds/ETFs: These allow you to invest in a basket of assets, spreading risk.

- Commodities: Gold and oil can be excellent hedges against inflation.

3. Consider Alternative Investments

Want to get a bit more adventurous? Look into:

- Cryptocurrencies: High risk, but they’ve got potential for high reward.

- Peer-to-Peer Lending: Earn interest by lending money to individuals or small businesses.

- Art and Collectibles: Not just for the wealthy—these can appreciate significantly over time.

4. Regularly Rebalance Your Portfolio

Set a schedule—maybe annually or bi-annually—to review and adjust your investments. If one asset class is outperforming, it might be time to sell high and invest in something lagging behind. This keeps your risk level consistent.

5. Utilize Tax-Advantaged Accounts

Don’t forget about retirement accounts like 401(k)s and IRAs! They offer tax benefits, and many employers will match contributions, giving you free money. Just be sure to diversify within these accounts too.

Diversification Tips for Retirement Savings Accounts

Let’s get down to some diversification tips for retirement savings accounts:

- Start Early: The sooner you start, the more time your investments have to grow.

- Use Target-Date Funds: These automatically adjust the asset allocation as you approach retirement.

- Invest in Index Funds: They offer broad market exposure and typically have lower fees than actively managed funds.

Case Study: Real-Life Diversification Success

Meet Jane. At 30, she decided to start investing for retirement. Instead of sticking to just tech stocks, she diversified her portfolio:

- 50% in a mix of U.S. and international stocks

- 25% in bonds for stability

- 15% in real estate through a REIT

- 10% in alternative investments like cryptocurrencies

Fast forward to age 60, and Jane’s portfolio has weathered market storms and inflation, giving her a comfortable retirement. The lesson? Smart diversification pays off!

Conclusion: Your Path to a Secure Retirement

Diversification is not just a buzzword; it’s a crucial strategy for a successful retirement investment plan. By mixing asset classes, considering alternative investments, and regularly rebalancing your portfolio, you put yourself in a better position for stability and growth.

Don’t wait until the market shifts to think about your investments. Start implementing these strategies for diversification in retirement investments today, and who knows? You might just find yourself enjoying those golden years on a beach after all.

Key Takeaways:

- Diversification reduces risk and can lead to higher returns.

- Mix asset classes like stocks, bonds, and real estate.

- Regularly rebalance your portfolio to maintain your risk tolerance.

- Utilize tax-advantaged accounts for additional benefits.

So, what are you waiting for? Get out there and start diversifying! Your future self will thank you.