How Inflation Impacts Your Savings: Essential Tips For Protection

Inflation is that sneaky little monster lurking in your financial closet, eating away at the value of your hard-earned money. If you’ve ever noticed your favorite snack costing more or your rent creeping up, you’ve felt its sting. But how does inflation really impact your savings accounts, and what can you do to protect your savings from its relentless grip? Buckle up, because we’re diving deep into the world of inflation and your savings!

What You Need to Know About Inflation and Savings

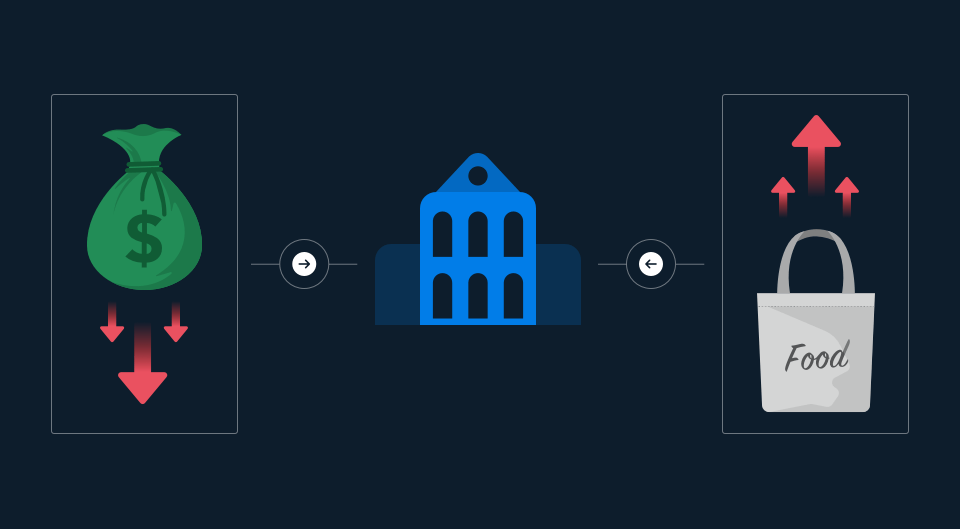

Inflation simply means that prices are rising. This reduces your purchasing power, making your money feel lighter than ever. When we talk about the impact of inflation on savings accounts, it’s essential to understand a few key factors:

-

Interest Rates: If your savings account interest rate is lower than the inflation rate, your money is effectively losing value.

-

Long-term Savings Plans: Inflation can drastically affect your long-term savings strategies. Think retirement accounts or college funds—if they aren’t keeping up with inflation, you could be in for a rude awakening when it's time to cash in.

Why Should You Care?

You might think, “I’ll just let my money sit in the bank.” But here’s the kicker: If inflation rates climb higher than your savings account's interest, you’re actually losing money over time. So, what can you do to protect your savings from inflation? Let’s explore some strategies!

How to Protect Your Savings from Inflation

1. Choose the Right Savings Account

Not all savings accounts are created equal. Here’s what to look for:

-

High-Interest Accounts: Seek out accounts that offer interest rates above the inflation rate. Online banks often have better rates than traditional banks.

-

Inflation-Protected Securities: Consider investing in Treasury Inflation-Protected Securities (TIPS), which are designed to keep up with inflation.

2. Diversify Your Investments

Don’t keep all your eggs in one basket! Here’s why diversification is your best friend:

-

Stocks and Bonds: A mix of stocks (which can outpace inflation) and bonds can provide a buffer.

-

Real Estate: Properties generally appreciate over time, often outpacing inflation, making real estate a solid long-term investment.

3. Create a Budget and Stick to It

Knowing where your money goes can help you save more effectively. Here are some tips:

-

Track Your Spending: Use apps or spreadsheets to monitor your expenses.

-

Set Savings Goals: Aim for specific targets—like saving for a vacation or a new car—to keep motivation high.

4. Increase Your Income

Sometimes the best defense is a good offense. Here’s how you can boost your income:

-

Side Hustles: Explore freelance work, tutoring, or selling crafts online to supplement your income.

-

Negotiate Your Salary: Don’t be shy about asking for a raise. If your pay doesn’t keep up with inflation, you’re effectively earning less.

5. Educate Yourself About Inflation Rates and Their Effect on Savings

Knowledge is power! Stay informed about current inflation rates and economic trends. Here’s how:

-

Follow Financial News: Stay updated with reliable financial news sources.

-

Understand Economic Indicators: Familiarize yourself with key indicators like the Consumer Price Index (CPI) and how they relate to inflation.

Strategies for Saving Money During Inflation

Saving money during inflation can feel like trying to swim upstream, but it’s possible! Here are some actionable strategies:

-

Automate Your Savings: Set up automatic transfers to your savings account to ensure you’re consistently saving.

-

Take Advantage of Discounts: Use coupons, cashback apps, and rewards programs to stretch your dollars further.

-

Buy in Bulk: Stock up on non-perishable items when they’re on sale. This can save you money in the long run.

-

Review and Adjust Regularly: Periodically review your financial strategy. As inflation rates change, so should your approach to saving and investing.

Real-Life Example

Let’s say you have $10,000 in a savings account with an interest rate of 1%, and the current inflation rate is 3%. After one year, your balance will grow to $10,100. However, due to inflation, what you can actually buy with that money has decreased. You’re effectively $1,900 poorer in terms of purchasing power. Ouch!

Conclusion: Stay Proactive to Protect Your Savings

Inflation doesn’t have to be a four-letter word in your financial vocabulary. By understanding its impact on your savings and implementing smart strategies to combat it, you can protect your hard-earned money. Focus on choosing the right savings accounts, diversifying your investments, budgeting wisely, and staying informed about inflation rates.

Remember, the key to financial success in a fluctuating economy is not just to react but to be proactive. So get out there, arm yourself with knowledge, and make your money work for you—even in an inflationary world!

With these insights and tips, you’re now equipped to tackle inflation head-on. Don’t let it catch you off guard—take control of your financial future today!