Exploring Mark Bezos' Investment Portfolio: Strategies For Success

Are you curious about how Mark Bezos, brother to the famous Jeff Bezos, navigates the world of investments? Well, you’re in the right place! In this article, we’ll dive into Mark Bezos' investment strategies, portfolio diversification, and venture capital investments. By the end, you’ll not only have a clearer view of his financial acumen but also some actionable insights that you can apply to your own investment journey. So, let’s get started!

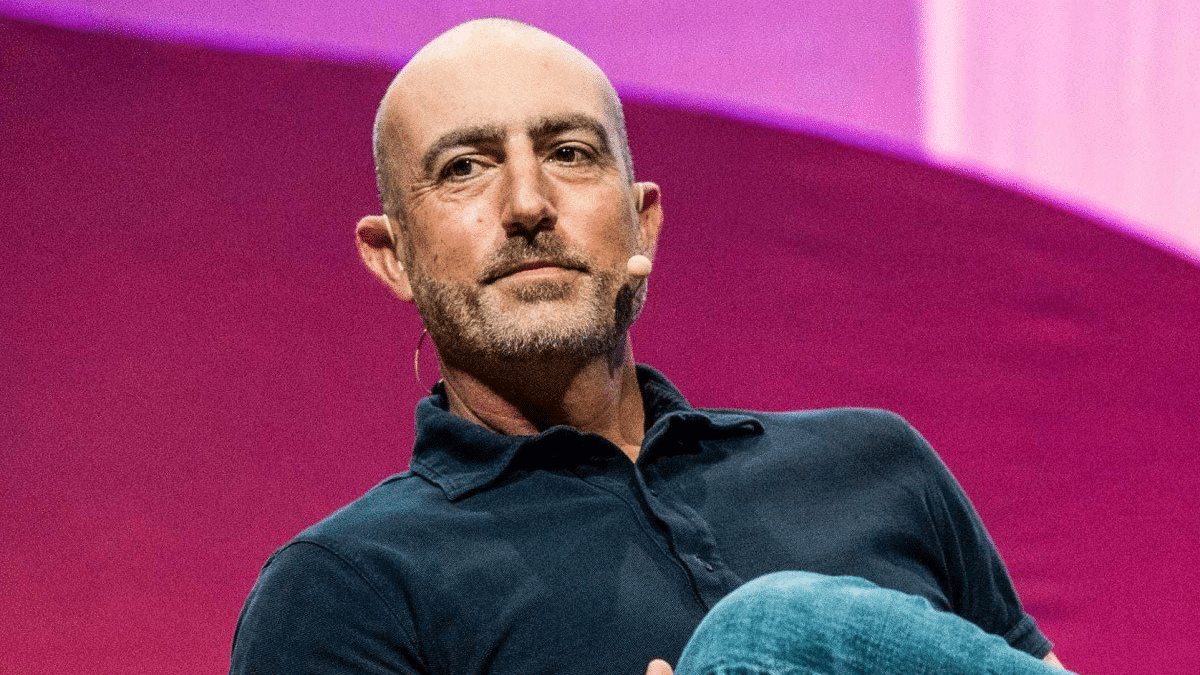

Who is Mark Bezos?

Before we dive into the nitty-gritty of his investment strategies, let’s quickly recap who Mark Bezos is. Mark is not just the sibling of one of the richest men in the world; he’s a successful entrepreneur in his own right. He co-founded the innovative marketing company, Blue Origin, and has a reputation for being a savvy investor. His approach to investment is as unique as his career path, and it’s worth exploring.

Mark Bezos' Investment Strategies

Mark Bezos employs a variety of investment strategies that focus on portfolio diversification and smart capital allocations. Here’s what you need to know:

1. Portfolio Diversification

Why diversify? Simple. It’s all about minimizing risks and maximizing returns. Mark believes in spreading investments across different sectors to cushion against market fluctuations. Here are some key areas he focuses on:

- Technology Startups: Investing in tech firms, especially those with innovative solutions, is a hallmark of his strategy.

- Sustainable Companies: Mark has a keen interest in businesses that prioritize sustainability and social responsibility.

- Consumer Goods: He also looks at companies that cater to everyday needs, ensuring stability in his investments.

2. Venture Capital Investments

Mark Bezos isn’t shy about diving into the world of venture capital. He identifies promising startups and emerging companies that have the potential for exponential growth. This strategy not only offers high returns but also keeps him at the forefront of innovation. Some notable sectors he’s interested in include:

- Health Tech: With the rise of telemedicine and health apps, this sector is booming.

- Green Energy: Companies focused on renewable energy sources are increasingly capturing his attention.

- E-commerce: Given his family background, it’s no surprise he keeps an eye on the e-commerce landscape.

3. Hands-On Approach

Unlike many investors who prefer a passive approach, Mark engages actively with the companies he invests in. He often offers mentorship and guidance, leveraging his experience to help these businesses thrive. This hands-on strategy not only strengthens his portfolio but also fosters innovation.

Mark Bezos' Investment Companies

Let’s take a closer look at some of the companies and sectors that define Mark Bezos’ investment landscape:

- Blue Origin: While primarily known for space exploration, the company also has investments in various tech sectors that align with sustainable practices.

- Various Tech Startups: Mark often collaborates with venture capital firms to get insights into the most promising tech startups, ensuring he’s always ahead of the curve.

Mark Bezos' Net Worth and Investments

As of 2023, Mark Bezos' net worth is estimated to be around $1 billion. This impressive figure is a result of his strategic investments and successful entrepreneurial ventures. Here are some insights into how he built his wealth:

- Smart Investment Choices: Mark's ability to identify high-potential investments early on has significantly contributed to his wealth.

- Reinvestment: He often reinvests his earnings into new ventures, creating a cycle of growth.

- Networking: Leveraging connections in the tech world, he gains access to exclusive investment opportunities.

Key Takeaways from Mark Bezos' Investment Approach

So, what can you learn from Mark Bezos’ investment strategies? Here’s a quick summary:

- Diversify Your Portfolio: Don’t put all your eggs in one basket; spread your investments across various sectors.

- Consider Venture Capital: Engaging with startups can yield high rewards, but do your research!

- Be Hands-On: If you can, actively participate in the companies you invest in—your insights can make a difference.

- Stay Current: Keep an eye on emerging trends and technologies that could shape the future.

Conclusion

Mark Bezos' investment strategies offer valuable lessons for anyone looking to enhance their financial portfolio. With a focus on diversification, venture capital, and active engagement, he demonstrates that success in investing is not just about numbers but also about relationships and foresight.

Whether you’re a seasoned investor or just starting, take a page from Mark’s book and consider how you can implement these strategies in your own financial journey. Who knows? You might just find yourself on the path to success!

With these insights in hand, it’s time to start crafting your own investment story. Remember, the best time to start was yesterday; the second-best time is now. Happy investing!