5 Proven Strategies For Successful Dividend Stock Investing

If you’re looking to make your money work for you while enjoying a steady stream of income, dividend stocks are your golden ticket! But wait—before you dive headfirst into the stock market, let's talk strategy. This article will guide you through the best investing strategies for dividend stocks that can help you maximize returns and build wealth over time. Ready? Let’s get started!

Why Dividend Stocks?

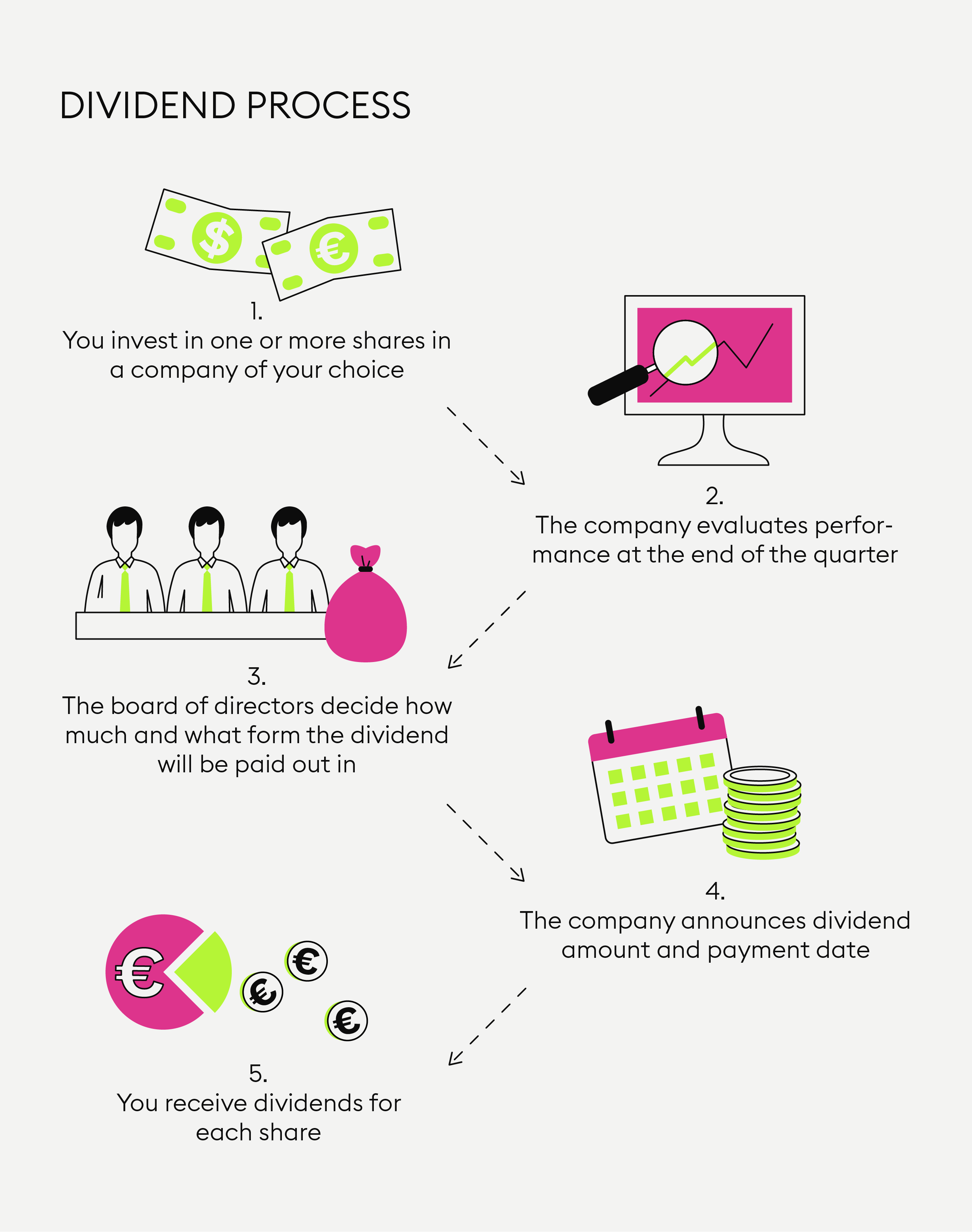

Dividend stocks are shares in companies that return a portion of their profits to shareholders, typically on a quarterly basis. This means you can enjoy a regular cash inflow while also benefiting from potential stock price appreciation. Sounds fantastic, right? But to truly reap the rewards, you need a solid plan.

What Will You Learn?

- How to create a dividend stock investment plan

- Top dividend stocks for long-term investing

- Dividend stock investing strategies for beginners

- Maximizing returns with dividend stock strategies

So buckle up, and let’s explore five proven strategies that can help you succeed in dividend stock investing!

1. Know Your Goals

Before you start buying stocks, ask yourself: What do you want to achieve? Whether it’s generating passive income for retirement or funding a dream vacation, defining your goals will shape your investment strategy.

- Short-term goals: If you’re looking for quick cash flow, focus on high-yield dividend stocks.

- Long-term goals: For wealth accumulation, consider companies with a history of increasing dividends over time.

Example:

If your goal is to retire comfortably, you might prioritize stocks from companies with a strong history of dividend growth, like Johnson & Johnson or Procter & Gamble.

2. Diversify Your Portfolio

You wouldn’t put all your eggs in one basket, right? Diversification is crucial in mitigating risk. By investing in various sectors and asset classes, you’ll be better equipped to weather market fluctuations.

- Consider sector diversity: Invest in different industries—like healthcare, technology, and consumer goods—to spread risk.

- Include international stocks: Look beyond your local market for dividend-paying stocks in other countries.

Tip:

Consider using ETFs or mutual funds focused on dividend stocks to achieve instant diversification without needing to pick individual stocks.

3. Reinvest Your Dividends

Why let that sweet cash just sit there? Reinvesting your dividends can significantly boost your returns over time through the magic of compounding.

- Dividend Reinvestment Plans (DRIPs): Many companies offer DRIPs, allowing you to automatically reinvest dividends into additional shares, often at a discount.

- Compound Interest: The more shares you own, the more dividends you earn, creating a snowball effect.

Fun Fact:

According to a study by Hartford Funds, reinvesting dividends can significantly increase your total returns over the long term—sometimes by as much as 75%!

4. Focus on Dividend Growth

Investing in companies with a history of dividend growth is like finding a hidden treasure. These companies are often financially stable and committed to returning value to their shareholders.

- Look for a Dividend Aristocrat: These are companies that have consistently increased their dividends for 25 years or more. Think of companies like Coca-Cola or 3M.

- Assess the payout ratio: A lower payout ratio (ideally below 60%) indicates that a company can sustain and grow its dividends without risking its financial health.

Key Insight:

Investing in top dividend stocks for long-term investing means you’re not just looking at current yields but also considering future growth.

5. Monitor and Adjust Your Strategy

The market is always changing, and so should your strategy! Regularly reviewing your portfolio will help you stay on track and make necessary adjustments.

- Review performance: Check how your dividend stocks are performing at least once a year—are they meeting your expectations?

- Stay informed: Keep an eye on news that could impact your investments, such as changes in management, earnings reports, or economic indicators.

Pro Tip:

Use tools like stock screens or financial news websites to stay updated on your investments and the overall market landscape.

Conclusion

Investing in dividend stocks can be a rewarding journey when approached with a solid strategy. By knowing your goals, diversifying your portfolio, reinvesting dividends, focusing on growth, and regularly monitoring your investments, you can effectively navigate the world of dividend investing.

So, are you ready to take the plunge? Start creating your dividend stock investment plan today, and watch your investments flourish! Remember, the key to success is not just about picking the right stocks but also about having the right strategies in place. Happy investing!