Understanding Intestate Inheritance Rules: What Happens When You Die Without A Will?

Have you ever wondered what happens to your belongings if you kick the bucket without a will? Spoiler alert: it’s a bit messy! Intestate inheritance rules can vary wildly by state, and navigating these laws can feel like a game of legal Twister. Let’s break it down in a way that makes sense, shall we?

In this article, we’ll dive into how intestate inheritance works, dissect the intestate succession laws, and discuss what it means for unmarried partners. We’ll also explore the impact of intestate inheritance on your estate planning. Ready? Let’s go!

What Is Intestate Inheritance and Why Does It Matter?

Intestate inheritance occurs when someone dies without a legally valid will. In such cases, the state steps in to distribute the deceased's assets according to intestate succession laws.

Key Takeaways:

- No will? No problem! Well, sort of—your state decides who gets what.

- Every state is different: Intestate inheritance rules by state can vary significantly.

- Your loved ones could miss out: If you don’t plan, your assets might go to someone you wouldn’t choose.

Now, let’s explore how intestate inheritance works in more detail.

How Intestate Inheritance Works: The Basic Breakdown

When you die intestate, it’s like leaving a pizza party without specifying your toppings. Here’s how the process generally unfolds:

-

Estate Administrator: A court appoints someone to manage the deceased's estate. This person is often a close family member but can be anyone the court deems fit.

-

Asset Inventory: The administrator must gather and assess all assets, from bank accounts to property.

-

Debt Payment: Any outstanding debts and taxes must be paid before assets can be distributed.

-

Distribution: Finally, assets are distributed according to state intestate succession laws.

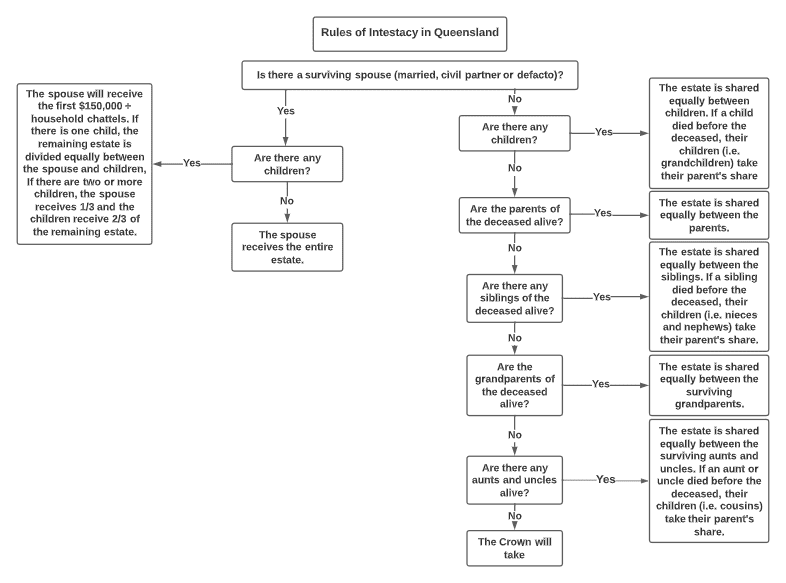

Who Gets What? The Distribution Rules

Intestate succession laws explain how assets are divided among heirs. Here’s a simplified version of how it typically works:

- Spouse and Children: In many states, if you’re married and have children, the spouse usually gets a significant portion, often half or more, while children share the rest.

- No Spouse? No Kids? Parents, siblings, and even more distant relatives may inherit instead.

- Unmarried Partners: If you have a partner but aren’t married, don’t expect the state to recognize your bond. They usually get nothing unless you’ve made plans to include them.

Intestate Inheritance Rules By State: A Quick Overview

Here’s a snapshot of how a few states handle intestate inheritance:

- California: Spouse gets 100% if there are no children. If children are involved, the spouse gets half, and the rest goes to the kids.

- Texas: Similar to California, but with a few nuances depending on whether the deceased had children from previous relationships.

- New York: Spouse and children split the estate, with specific percentages depending on the number of children.

For a detailed look at intestate inheritance rules by state, check out this comprehensive guide.

Intestate Succession Laws Explained

Intestate succession laws are designed to provide a fair distribution of assets when someone dies without a will. These laws are generally guided by the principle of kinship—meaning that the closer you are related to the deceased, the more you’re likely to inherit.

Factors Influencing Distribution

- Marital Status: Your marital status can drastically change inheritance outcomes. Married folks usually win big!

- Children: Biological and legally adopted children are typically treated equally.

- Other Relatives: If no immediate family exists, the state may look to distant relatives, which can lead to some unexpected inheritances.

Are you starting to see why having a will is crucial? It’s not just about who gets your stuff—it’s about ensuring your wishes are respected.

Intestate Inheritance for Unmarried Partners

Let’s get real. If you’re not married, intestate inheritance can leave your partner in a lurch. Most states don’t consider unmarried partners as legal heirs, meaning they could walk away with nothing.

What Can You Do?

- Create a Will: This is the most straightforward way to ensure your partner is taken care of.

- Beneficiary Designations: Make your partner a beneficiary on accounts and insurance policies.

- Joint Ownership: Consider joint ownership of property, which can bypass intestate laws.

The Impact of Intestate Inheritance on Estate Planning

Now that you know how intestate inheritance works, let’s chat about its impact on estate planning.

Why Plan Ahead?

- Control Over Your Assets: Writing a will gives you control over who gets what. No more surprises!

- Reduce Family Conflicts: Clear instructions can prevent disputes among loved ones.

- Save Time and Money: Avoid lengthy probate processes and legal fees.

Key Steps for Effective Estate Planning

- Draft a Will: Make it official!

- Review Your Beneficiaries: Don’t forget about accounts and policies.

- Consult an Attorney: A little expert advice can go a long way.

Conclusion: Take Charge of Your Legacy

Intestate inheritance rules can feel overwhelming, but don’t let that scare you! Understanding how intestate succession works is the first step toward taking control of your legacy.

Remember, the state shouldn’t have the final say in what happens to your assets. Plan ahead to ensure your wishes are honored, whether you’re single, married, or in a committed partnership.

So, what are you waiting for? Grab that pen and start planning your estate today. Your loved ones will thank you!

Key Takeaways

- Intestate inheritance means the state decides who gets your stuff.

- Rules vary by state, so know your local laws.

- Unmarried partners often miss out—be proactive!

Now that you’re armed with knowledge, go forth and make informed decisions about your estate!